A very special Sense for Assets & Locations

- Family-owned and managed real estate investment company

- ACRON fosters a sense of belonging by making investors part of the ACRON family

- ACRON builds the bridge between investors and unique properties since 1981.

- Mission: Responsible, transparent, and secure handling of capital for both ACRON and its investors

- Investment strategy involves actively investing alongside our investors

- Tailor-made and sound investment policy prioritizing safety and transparency

- Goal: Preserve and build wealth to successfully pass it on to the next generation

Global Real Estate Investments: Prioritizing Security and Diversification

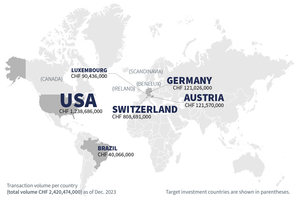

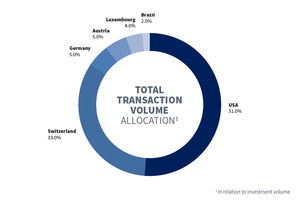

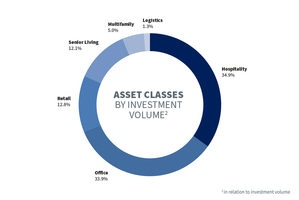

Our company has achieved a transaction volume exceeding CHF 2.4 billion in Switzerland, Europe, and notably, the USA. Real estate, renowned for its low correlation with other financial assets, stands as a pivotal component in diverse investment portfolios. We specialize in providing tailored solutions for investors seeking high and stable income returns. Recognizing the importance of international diversification to enhance the risk and return profile of portfolios, we adhere to the key principle of "safety first." Our primary focus lies in investments within safe havens. However, while maintaining stringent criteria for investment security, we remain open to considering opportunities in other stable real estate markets.

Contact us

André N. Lagler

Managing Director ACRON AG

Phone: +41 44 204 34 94

Mobile: +41 78 754 91 61

Email: andre.lagler@acron.ch

Jonas Lindblom

Managing Director ACRON AG

Phone: +41 44 204 34 91

Mobile: +41 79 459 28 42

Email: jonas.lindblom@acron.ch

Henrik Peters

Director Key Clients ACRON GmbH

Phone: +49 211 912 41 03

Email: henrik.peters@acron.de